Snippet: Halifax–Dartmouth prices are still trending up, but the Sept 17, 2025 Bank of Canada 25 bps cut could moderate the pace as affordability improves and more listings hit the market.

By Johnny Dulong, Family Real Estate Advisor — Exit Realty Metro (Halifax, NS)

Why this matters for Halifax right now

The Bank of Canada lowered the policy rate by 25 basis points to 2.50% on Sept 17, 2025, the second cut this year. Cheaper borrowing often brings more buyers off the sidelines—and encourages some sellers to list. In Halifax–Dartmouth, where supply has been tight and demand resilient, the key question is whether prices will keep climbing or cool to a slower pace as fall activity ramps up. (Bank of Canada)

What the latest Halifax–Dartmouth numbers say

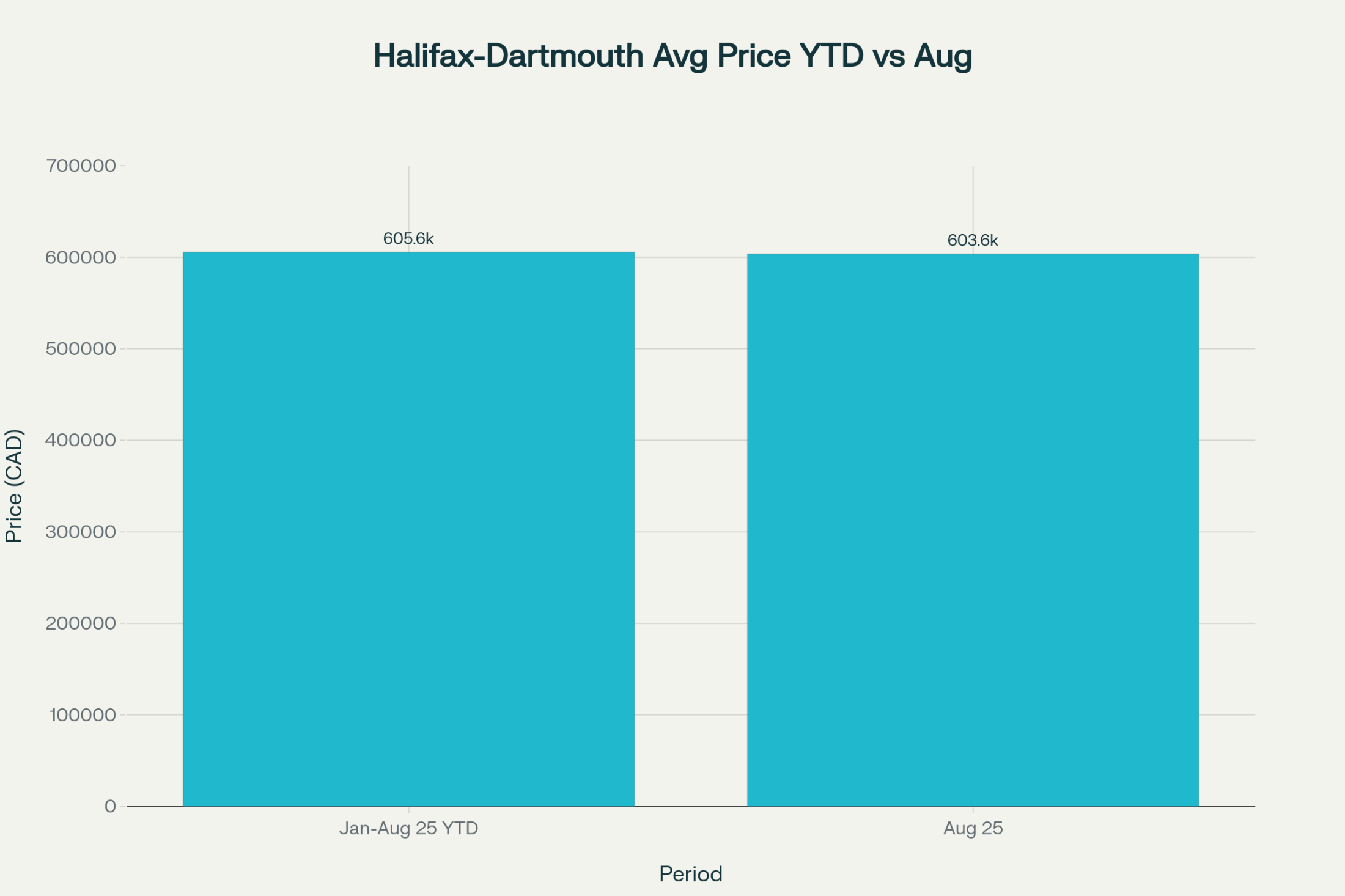

Average price (Aug 2025): $603,650 (+5.8% YoY)

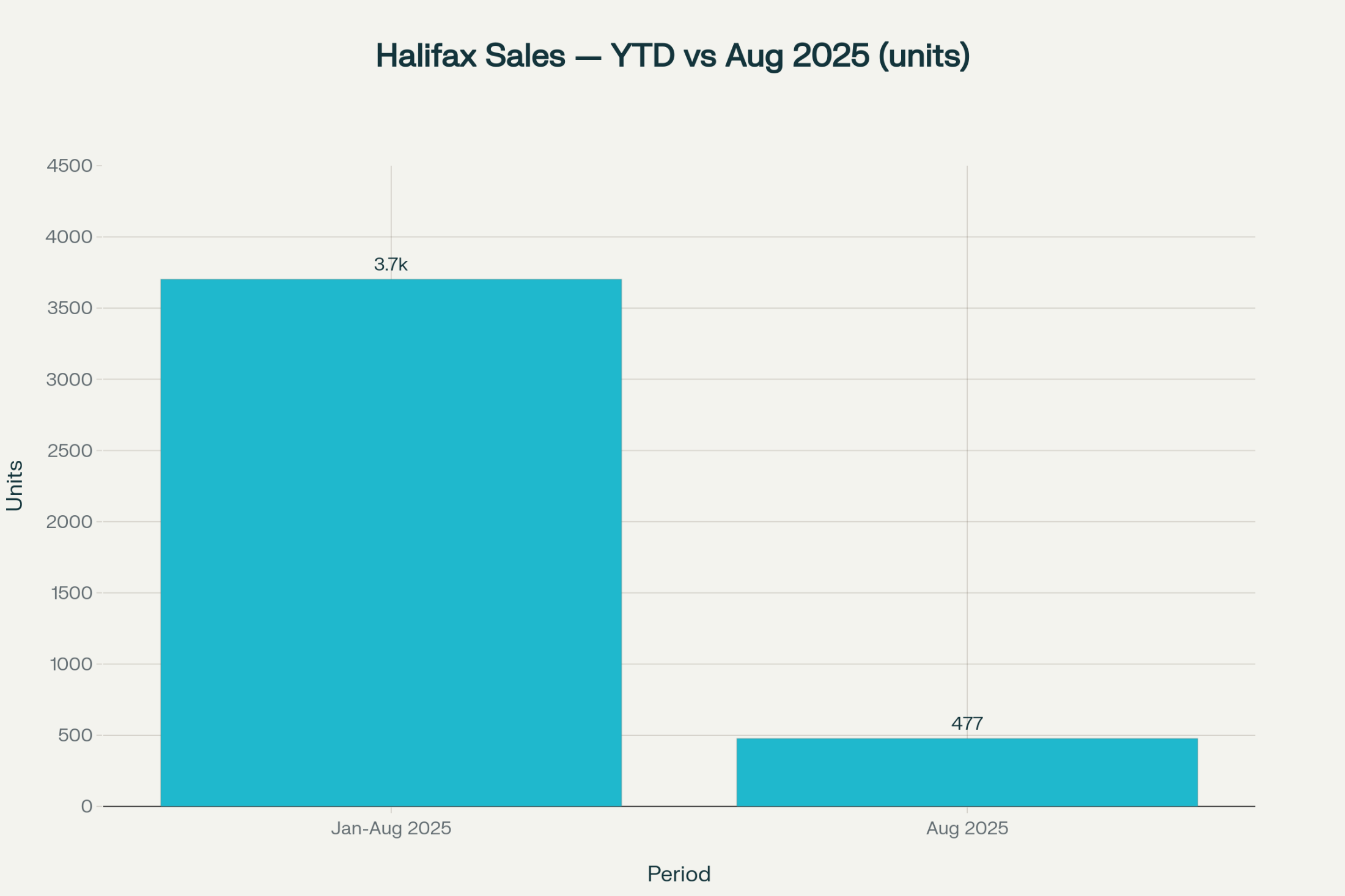

Sales (Aug 2025): 477 (–2.7% YoY)

These figures confirm the uptrend in prices across Greater Halifax (HRM), even as sales volumes in August ticked slightly lower year-over-year.

What the BoC rate cut changes

Affordability bump: A 25 bps reduction lowers typical mortgage rates modestly, improving purchasing power and widening the pool of qualified buyers.

Listing incentives: Sellers who waited for better conditions may list this fall, potentially adding inventory and easing bidding pressure.

Outcome to expect: In HRM, that likely translates to continued price resilience, with slower month-to-month gains if new listings rise.

The Bank of Canada’s policy rate is now 2.50% (cut on Sept 17, 2025). If economic risks persist, further easing remains possible, which would reinforce the direction above. (Reuters)

Halifax fall market: signals to watch

New listings vs. sales: If new listings outpace absorbed sales, price growth can flatten even with strong demand.

Neighborhood micro-trends: Family segments in Bedford, Clayton Park, Dartmouth often move first—watch DOM (days on market) and sale-to-list ratios there.

Migration & rentals: HRM’s in-migration and tight rental market support ownership demand; CMHC expects gradual easing but not a quick reversal. (CMHC)

Will prices rise or slow?

Short answer:

Rise: Structural demand in HRM remains healthy; August’s +5.8% YoY price data backs that up.

Slow: As borrowing costs ease, inventory may increase, tempering the pace of gains—especially if sales don’t spike at the same rate.

Think of this as a “glide path” rather than a “flip.” A cooling in the rate of increase is more realistic than outright declines unless supply rises sharply or macro conditions weaken materially.

What this means for you

If you’re buying in Halifax–Dartmouth

Get pre-approved now—rate moves can change affordability week to week.

Target “list-to-last 30 days”: prioritize homes that just hit the market post-cut; they’re most sensitive to new buyer traffic.

Use outs in your offer (financing, inspection) but stay competitive on terms in family-friendly price bands.

If you’re selling

This fall is attractive: demand is buoyed by cheaper mortgages; supply hasn’t flooded (yet).

Preparation wins: light improvements + professional visuals still drive stronger SP/LP ratios.

Consider pricing to the bracket just below a common search ceiling to capture more saved searches.

If you’re investing

Vacancy should remain low by historical standards, even if it eases; rent fundamentals in HRM are still supportive. Evaluate cash flow at today’s rates and re-run pro formas under another 25–50 bps of potential easing. (CMHC)

FAQ: Halifax after the BoC cut

Will prices drop because rates fell?

Unlikely in the short run. Rate cuts typically support demand; any moderating effect comes from more listings, which temper the pace of price gains rather than reversing them immediately.

Is fall better than waiting for spring?

Fall 2025 offers motivated demand with slightly less competition than peak spring. Spring could be hotter if rates drift lower again.

What if I need to sell and buy?

List after you’ve spoken with your lender about updated approval numbers. Tie purchase conditions to sale timelines to reduce risk.

Bottom line for Halifax–Dartmouth

Prices: rising YoY, with signs of slower month-to-month gains ahead if supply builds.

Rate cut (2.50%): modest affordability boost that could pull buyers back—and prompt some owners to list.

Strategy: move decisively with financing, price to the bracket, and watch new-listing flow over the next 4–8 weeks.

Sources

Bank of Canada — “Bank of Canada lowers policy rate to 2½%” (Press release, Sept 17, 2025). (Bank of Canada)

NSAR — MLS® Statistical Report (Aug 2025), Halifax–Dartmouth row: $603,650 avg price, 477 sales, +5.8% YoY price, –2.7% YoY sales.

(Context) CMHC — Housing Market Outlook 2025: rental conditions expected to ease gradually from very tight levels. (CMHC)

Call to action

Thinking of buying or selling in HRM? Get a custom game plan for your street and price band.

Call/Text: 902-209-4761 · Email: johndulong@exitmetro.ca

Johnny Dulong, Family Real Estate Advisor — Exit Realty Metro (Halifax, NS)