Welcome to 2026. If you’ve been waiting for the Halifax market to take a breath, you can finally exhale.

For the last five years, buying a home in the HRM felt like a sprint. Decisions had to be made in minutes, and conditions like inspections were often tossed aside just to compete. But as we settle into the first quarter of 2026, the narrative has changed. We have officially moved away from the chaos of the post-pandemic boom into a new era: Steady, Strategic, and Strong. 1

Here is everything you need to know about the Halifax market right now, from the latest interest rates to the neighbourhoods that are quietly outperforming the rest.

1. The Numbers: A Return to Sanity

The most important shift in January 2026 is the return of time. The frenetic bidding wars have largely subsided, replaced by a negotiation environment where you can actually take a weekend to think about a $600,000 decision.

Average Price: The average residential sale price in Halifax is hovering just over $600,000.2 Growth is projected at a moderate, sustainable 3% for the year.2

Inventory is Back: We started January with 646 homes on the market.3 While this isn't a massive surplus, it's a significant improvement that gives buyers genuine choices.

The Pace Has Slowed: The average listing is currently spending about 107 days on the market.3 This includes some stale inventory from late 2025, but it signals that homes are no longer "selling themselves" in 24 hours.

The Takeaway: Buyers are no longer victims of circumstance. We are seeing a high rate of conditional deals, meaning buyers are successfully protecting themselves with financing and inspection clauses.3

2. The "Hidden" Costs You Need to Budget For

While the market pace is friendlier, the cost of entry remains steep. In 2026, the biggest hurdle for many isn't the monthly mortgage payment—it's the cash required on closing day.

The Mortgage Landscape

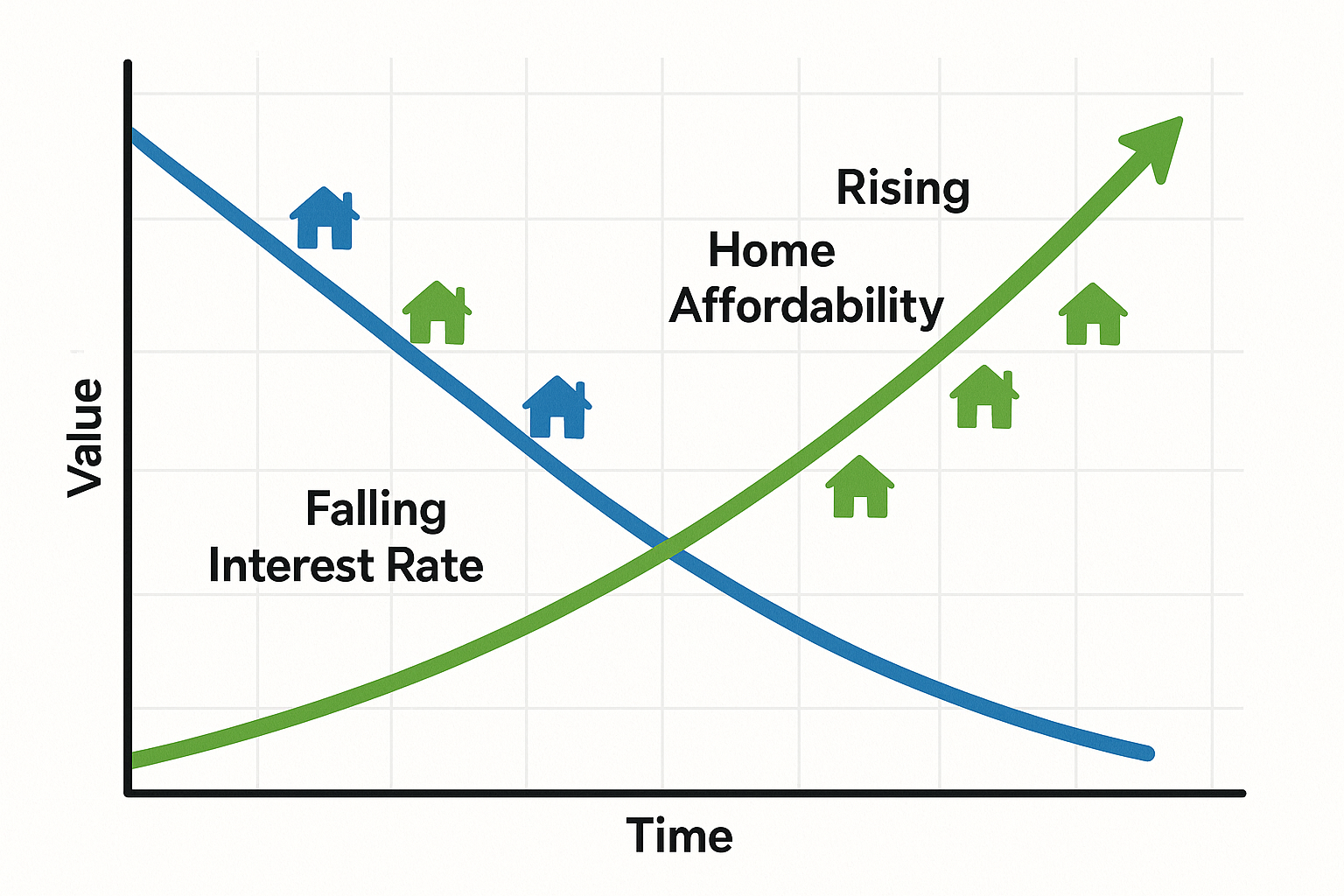

The shock of the rate hikes has settled. As of January 2026, 5-year fixed insured mortgage rates have stabilized around 3.84%.4 While this is much better than the peak, it still requires careful budgeting compared to the rates of a few years ago.

The Deed Transfer Tax Shock

One of the most common surprises for first-time buyers is the Deed Transfer Tax. This is not added to your mortgage; it is a cash cost due on closing day.

The Math: In the Halifax Regional Municipality (HRM), this tax is 1.5% of the purchase price.5

Real World Impact: On an average $600,000 home, you need to have $9,000 in cash ready for the municipality, on top of your down payment and legal fees.

For Investors & Non-Residents

If you are purchasing a property and are not a resident of Nova Scotia (and don't intend to move here within 6 months), be aware that the Provincial Non-Resident Deed Transfer Tax was increased to 10% last April.6

Example: An out-of-province investor buying a $600,000 rental property would face a provincial tax bill of $60,000 plus the municipal tax of $9,000.7

3. Neighborhood Watch: Where to Buy in 2026

Halifax isn't one single market; it's a collection of micro-markets. Here is where the smart money is looking this year.

⛴️ The Opportunity: Woodside & Dartmouth

While everyone fights over the North End, Woodside has emerged as a top neighbourhood for investment potential.1

Why? It offers a classic "arbitrage" opportunity. You are a 12-minute ferry ride from downtown Halifax, but prices are significantly lower than on the Peninsula or in Downtown Dartmouth.

The Catalyst: The massive Southdale Future Growth Node development is bringing hundreds of new units and infrastructure to the area, which usually precedes a jump in property values.8

🌲 The Value Leader: Timberlea

For first-time buyers, Timberlea remains the battleground. It offers the best balance of commute time (15 mins to the city) and lifestyle (access to the BLT trails).9

Market Note: Because the price point here is accessible (often under the $600k average), competition is fiercer here than in the luxury markets.

🏛️ The Safe Haven: The South End

If your goal is wealth preservation, the South End remains the gold standard.

Benchmark Price: ~$839,000+.10

Status: This market is insulated from volatility. With proximity to universities and hospitals, vacancy rates are low and asset values are incredibly sticky.2

4. What to Expect for the Rest of 2026

Looking ahead, we are seeing a divergence between property types.

Detached Homes: Demand remains strong. The "flight to quality" means single-family homes with yards are still the most coveted asset class.2

Condos: This segment is seeing some softening.2 Rising condo fees and the crackdown on Airbnbs (via the non-resident tax) have cooled investor demand here. If you are a buyer looking for a deal, the condo market might be where you find the most negotiation room.

The Bottom Line

The 2026 market rewards patience and preparation. You don't need to waive conditions anymore, but you do need to understand the math—specifically the taxes and closing costs—before you write an offer.

Are you looking to navigate the 2026 Halifax market? Whether you're eyeing a move to Woodside or selling in the South End, let's chat about your strategy.

Marketing your Halifax home effectively - https://sellhalifaxrealestate.com/blog.html/marketing-your-halifax-home-effectively-from-ai-staging-to-overcoming-8890863

How local families in the Halifax real estate market can prepare for new beginnings - https://sellhalifaxrealestate.com/blog.html/how-local-families-in-halifax-can-prepare-for-new-beginnings-8889584

Johnny Dulong - Family Real Estate Advisor

Call today .... EXIT tomorrow!

902.209.4761