The real estate market in Halifax, Nova Scotia, is changing. For those thinking about selling their homes and moving to a smaller place, this might be the perfect time. With more houses on the market and prices going down, it's a good idea to see what the market has to offer. Let's look at what's happening and who might benefit from these changes.

## A Shift Towards More Choices

### Problem: Falling Prices, More Options

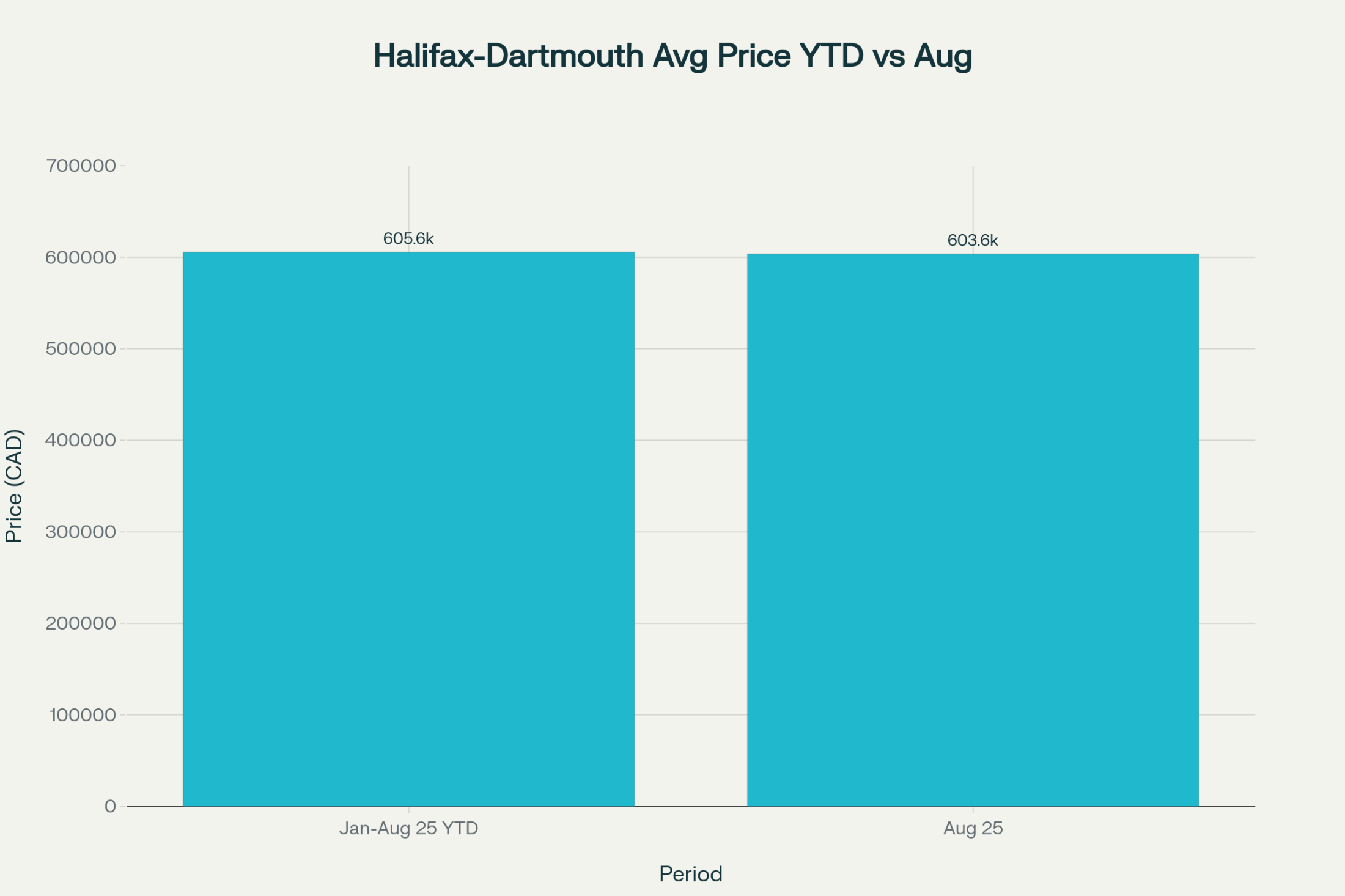

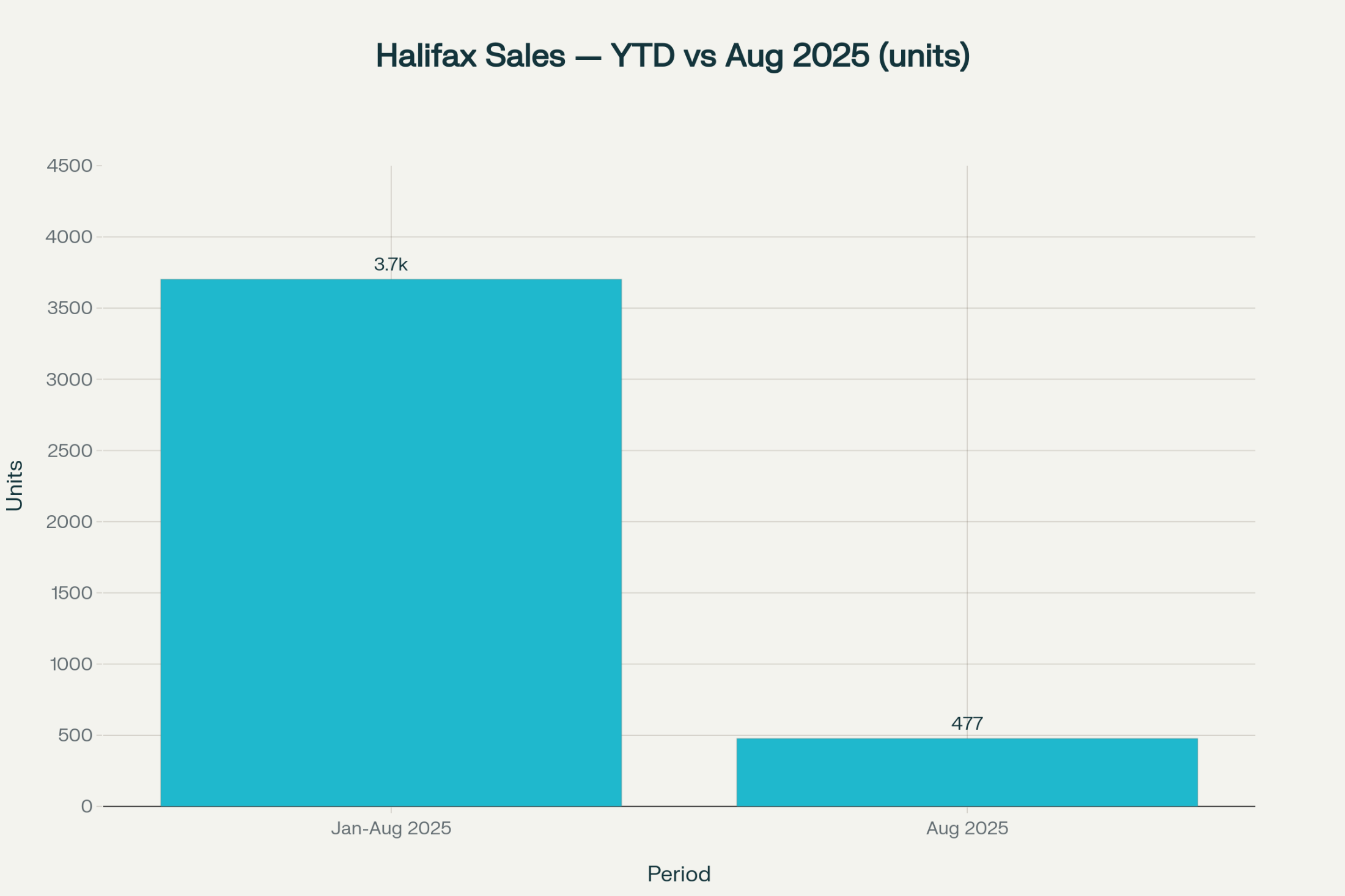

Recently, home prices in Halifax have been dropping, and there are more homes for sale than before. This means people looking to buy have more choices. Last year, the inventory of homes was very low, but now it has increased by 10%, giving buyers more options.

### Agitate: What This Means for Everyone

This shift can be good news for different groups. First-time home buyers may find it easier to enter the market with more homes to choose from and possibly lower prices. Upsizers, or families looking for larger homes, may find it a great time to sell their current homes and find a bigger space without stretching their budgets too much. Empty nesters and seniors looking to downsize may finally find suitable smaller homes or condos at reasonable prices, making their next move more affordable.

Meanwhile, members of the Canadian military moving to Halifax can take advantage of the increased housing options near bases like CFB Halifax. Relocating families can find homes quickly, reducing the stress of moving to a new place.

## Growing Families and Investors Take Note

For growing families, the opportunity to upsize is appealing. As inventory rises, families can look for homes with more space, such as extra rooms or larger yards, to fit their changing needs. Prices are more competitive now compared to the height of the market last year, making it a strategic time to move.

Local investors might also find this market shift attractive. Investment properties are more available, creating better opportunities for securing property with rental prospects. As the rental market remains strong, investing wisely now could yield good returns.

## Solutions for Buyers and Sellers in Halifax

### For First-Time Home Buyers

If you're buying your first home, take advantage of the inventory. More homes on the market might mean lower prices and less pressure to bid over asking. Remember to get pre-approved for a mortgage to know your budget, and consider looking at different neighborhoods that you might not have considered before.

### For Families Looking to Upsize

Considering a move to a larger home? Now might be the best time. The increase in inventory means you'll find more properties that suit your needs. Since prices are not as high as last year, you might be able to negotiate a good deal. It’s smart to sell your current home now while there’s still demand in certain neighborhoods.

### For Seniors and Empty Nesters Wanting to Downsize

If you're a senior or an empty nester, the current market is in your favor. With more options available, finding a smaller, more manageable home is easier. Look for homes that match your needs, like single-level properties or condos with amenities that suit your lifestyle.

### For Canadian Military Members

Relocation to CFB Halifax can be smooth with the current market conditions. More homes for sale mean you can find a house nearby without too much stress. It’s a good idea to connect with local real estate professionals who are familiar with military relocations for personalized help.

### For Investors

Now is a great time to explore investment properties. With a rise in available properties and stable rental demand, investors have a chance to add valuable properties to their portfolios. Focus on areas with high rental demand or near military bases for steady income.

## What If the Market Trends Continue?

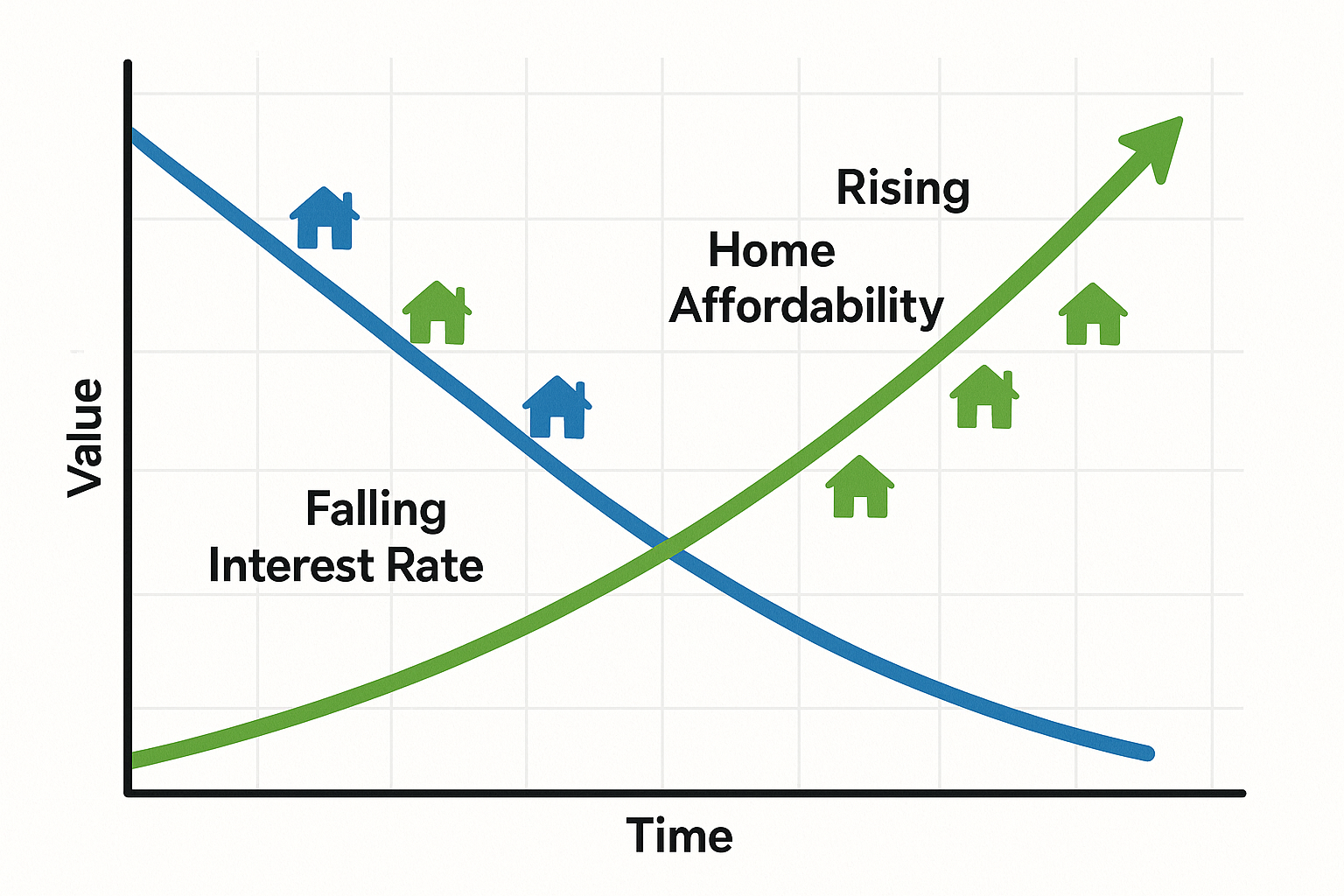

Looking ahead, if the trend of more inventory and price reductions continues, the Halifax real estate market might become even more favorable for buyers. However, it's important to keep an eye on interest rates, as changes can affect affordability. Sellers should consider acting sooner rather than later to capitalize on current prices before potential future declines.

## Final Thoughts: Seizing Opportunity

The shifting Halifax real estate market offers unique opportunities for various buyers and sellers. Whether you're buying your first home, upsizing, downsizing, or relocating, understanding these trends can help you make smart decisions. Consulting with a real estate professional can provide insights tailored to your situation, ensuring you navigate the market with confidence. Opportunity awaits—it's about taking the next step that's right for you.

Johnny Dulong - Family Real Estate Advisor

Call today .... EXIT tomorrow!

902.209.4761

#HalifaxRealEstate #HomesinHalifax #HalifaxRealtor #NSRealEstate #DartmouthRealEstate #BedfordRealEstate #FirstTimeBuyer #MovetoNovaScotia #SellHalifaxRealEstate #BedfordHomesForSale #MilitaryRelocation